Introduction

In these series of articles (start here), we have been looking at different ways you can invest your money to grow it and achieve your financial goals.

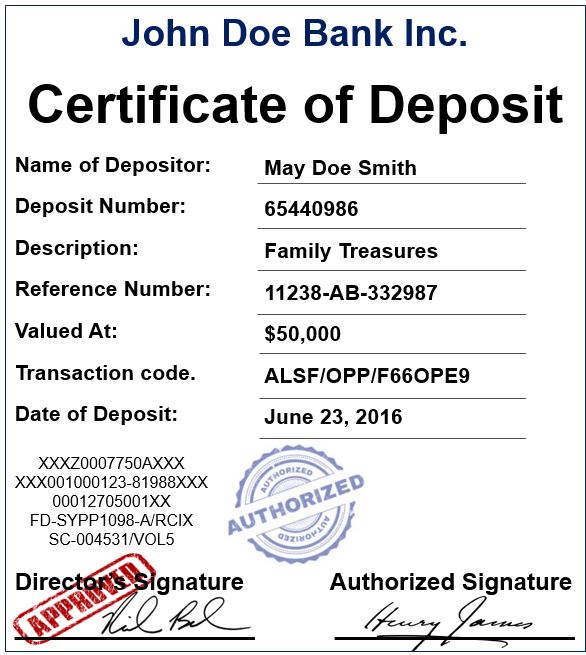

Today, we look at certificates of deposits as one of those tried and tested investment channels you need to consider in your investment portfolio

What are Certificates of Deposit?

Certificates of Deposits are products offered by banks and credit unions whereby an investor deposits money and leaves it untouched for a predetermined period (term) in exchange for periodic interest payments.

Features of Certificates of Deposit

- Fixed-deposit: CDS are fixed deposits, and the investor cannot withdraw the money before the maturity date without paying an early withdrawal penalty (ceteris paribus).

- Fixed interest rate: The bank or credit union sets the interest rate on a CD for the term of the fixed deposit. The interest rate does not change with market dynamics. The interest rate accumulates either on a monthly or quarterly basis.

- Maturity Date: Every CD has a term ranging from 6-months, one year, two years, and five years (generally). The maturity date is when the term ends, and the principal and interest accumulated during the term becomes payable.

- Lump-sum payment: Generally, you can only make a single lump-sum payment to one CD account. You cannot top up your deposit during the term of the CD. If you need to invest more money, you have to open separate accounts.

- Minimum Deposit: Every bank or credit union has a minimum deposit requirement.

- Maturity: When a CD matures, you can either withdraw the money, roll it over to a new CD, or transfer it to a saving or checking account at the same bank.

- Tax: Interest earned on CDs are taxable. The interest is taxed when the bank adds the interest to the balance on your account and not at withdrawal.

- Withdrawal Penalty: Each bank and credit union has different policies regarding the early withdrawal penalty. Generally, the penalty is always in the form of interest payments for a specified period. For example, if you purchase a one-year CD and wish to withdraw before maturity, the penalty can be the forfeiture of a month to three months’ interest out of the interest accumulated until date. The interest you forfeit (number of months) will be higher for CDs with longer terms (up to 6 months for a three-year CD)

- Safety: The FDIC (for banks) and NUCA (for credit unions) protect your deposit in a CD for up to $250,000 per account.

CDs vs. Savings Accounts vs. Money Market Accounts

How do CDS compare with Savings accounts?

While a savings account allows you to make six withdrawals per month, a CD is fixed for the term of the agreement. Generally, you cannot withdraw your money before the maturity date on the CD. Savings accounts are liquid, while CDS are not.

However, CDS pay a higher interest rate than savings accounts. The higher interest rate compensates for the illiquidity of the money.

Most savings accounts do not have a minimum deposit requirement, while CDs require minimum deposits.

CDS are also different from the money market deposit account due to their illiquidity. The latter also allows six withdrawals per month with some features of a checking account.

Direct CDs vs. Brokered CDS

You can buy CDs directly from banks and credit unions. Alternatively, you can buy them through your brokerage firms.

Brokered CDs pay lower rates, but they are easier and more convenient to set up and operate. Since you have an account with the brokerage firm, they can easily set up a CD without all the attendant paperwork. Upon maturity, they will also easily transfer the money to your cash account with the firm.

Factors affecting the interest rate on CDs

Two major factors affect the interest rate on CDs

- Federal Funds Rate: There is a direct relationship between the federal funds rate and the interest rate on CDs. When the FFR is low, banks do not have an incentive to borrow from the public, which results in low interest rates. Conversely, when the FFR is high, banks will prefer to borrow from the public, which makes CDS more desirable. Consequently, the interest rate rises.

- Demand-side: Banks lend money to give out loans to their customers. One way they lend money is through the CDs. Therefore, when a bank has a low demand for its loans, there will be less interest in issuing CDs (lower rates), vice versa.

Specialty CDs

While many of the features of CDs listed above apply in a wide range of cases, some specialty CDs offer more flexibility on one of those features.

No-penalty CDs

Some certificates of deposits overrule the early withdrawal penalty that is a standard feature of CD. The trade-off is in the interest rate. These no-penalty CDS will offer lower interest rates than the standard CD.

Add-on CDs

Add-on certificates of deposits offer flexibility with the lump sum, fixed-deposit feature of CDS. They allow you to make additional deposits during the term of the CD. These additional deposits also earn taxable income. All the deposits and interest earned are payable at maturity.

Bump-up CDs

A bump-up CD offers flexibility with the fixed interest rate feature of CDS. It gives you one opportunity to lock in a higher rate during the term of the CD. It means when the current interest rate exceeds the interest rate when you purchased the CD, you can lock in the current interest rate and override the initial rate. However, you can only do this once during the term of the CD.

Jumbo CDs

These CDs tend to have a higher minimum deposit requirement than others. Some Jumbo CDs can have a $25,000 minimum deposit requirement. Others can have a $50,000 minimum deposit requirement. These Jumbo CDs tend to pay a higher interest rate

IRA CDs

IRAs can also decide to invest in CDS. CDs specific to retirement accounts are called IRA CDs.

Callable CDS

These certificates of deposits give the issuer the legal right to recall the CDS at any time. Callable CDs do have a higher interest rate to compensate for the uncertainty they introduce. When the bank or credit union recalls a CD, it stops earning money, and thy return your principal and interest earned up to that point.

Pros of Certificates of Deposits

There are many advantages of certificates of deposits. Below are some of them:

- Higher interest rates than savings and money market accounts:

- Safe Investment: Your investment in a CD is backed the FDIC and NUCA (as applies) up to $250,000 per account

- Certainty: When you invest in a CD, you know how much you expect to withdraw at the end of the term. The interest rate and duration are fixed.

- Bolsters a saving culture: When you lock your money in a CD for a term without withdrawing (or withdrawing at a penalty), it helps to enhance your saving habit.

Cons of Certificates of Deposits

However, there are some downsides to CDs:

- Low interest rate: When compared to stocks and bonds, CDs offer a low interest rate. The industry rate may not even beat the inflation rate

- Early Withdrawal Penalty: Withdrawing money from a certificate of deposit before maturity attracts a penalty

- Opportunity Cost: When you lock your money in a CD, you cannot take advantage of higher interests rate later on (except for bump-up CDs). Also, you can’t take advantage of better investment opportunities without a cost (except for no-penalty CDS that pay lower interest rates)

Should you buy Certificates of Deposit?

With these advantages and disadvantages, is it advisable to buy CDs?

- Use CDs to hold part of your emergency funds: CDs are good investment channels for emergency funds. The illiquidity of CDs may make you wonder if it is suitable for emergency funds. However, it should be said that emergency funds should not be too liquid. If they are, you would probably empty the account before there is a real emergency. CDs will grow your emergency funds faster while offering you the opportunity only to withdraw when there’s a real emergency (for fear of penalty). You would only be willing to take the penalty for a real need.

- Investment targets: There are times you save money to make some future purchases. You may want to save to buy a car, make a down payment on an apartment, go on vacation, etc. In these kinds of scenarios, investing in stocks or mutual funds won’t fit the bill. You will need a stable, safe, and secure investment where you cannot lose your money. In such instances, CDs are suitable investments.

Recommendations

Below are some suggestions for investing in certificates of deposits:

- Use a CD ladder system (similar to the bond ladder system): The ladder system allows you to minimize the risk of locking down your money. You can purchase a CD that matures in different periods. For example, you can buy a six months CD, a one year CD, a three year CD, and a five year CD rather than investing all your money in a five year CD. In this way, you can take advantage of the future rise in interest rate.

Instead of investing $100,000 in a five year CD paying 5%, you can invest $20,000 in six months, one year, two years, three years, and five year CD. At the end of the first six months, you can then purchase a five-year CD at a higher rate (if the rate is higher). The same thing applies at the end of the one-year, two years, and three year CD. This is especially helpful if you look forward to higher interest rates.

- Shop Around: CD rates vary across banks and credit unions. Some banks will pay three to four times more than the industry average. You must shop around to ensure you are getting the best value. The Balance has a website page where they update the top-paying CDs and their features.

- Embrace Odd terms CDs: These are CDs with 17 months, 21 months, etc. Some of these odd terms, CDs pay more than the conventional CDs (6 months, one year, and two years, etc.) with no extra downside. If the oddness of the term is the only problem, by all means, embrace odd term CDs with better interest rates.

- Be open to promotional offers but know all the details: Banks and credit unions do make promotional offers that pay higher interest rates. You should be open to such. However, you need to be sure of every single condition and feature.

- Have a plan: Always focus on the end game. Do not buy CDs for the sake of it. Ensure you buy them because they have a place in your overall financial plans and goals.

Conclusion

Certificates of deposits are one of the investment channels that every investor should know about and explore. They are a good place to hold your emergency funds and money for some short-term and medium-term purchases.

0 Comments