Examples of financial advisors who embrace storytelling

Financial advisors who want to gain more clients must embrace storytelling. That was the highlight of last week’s article.

In a world of numbers, graphs, and charts, financial advisors who want to excel and grain brand equity must embrace storytelling.

Consumers love stories because they are memorable. Stories connect with us emotionally. We change our worldviews and make decisions because of the stories we hear.

To make last week’s article more relatable, I researched financial advisors’ websites to give examples of how this storytelling works.

The examples below are not necessarily perfect; the advisors could have done it better. However, they are still illustrative of how storytelling works in business environments.

The Passion Story

The passion story is the “why” behind your advisory business. The why always takes the central stage – it controls the “what” and the “how.”

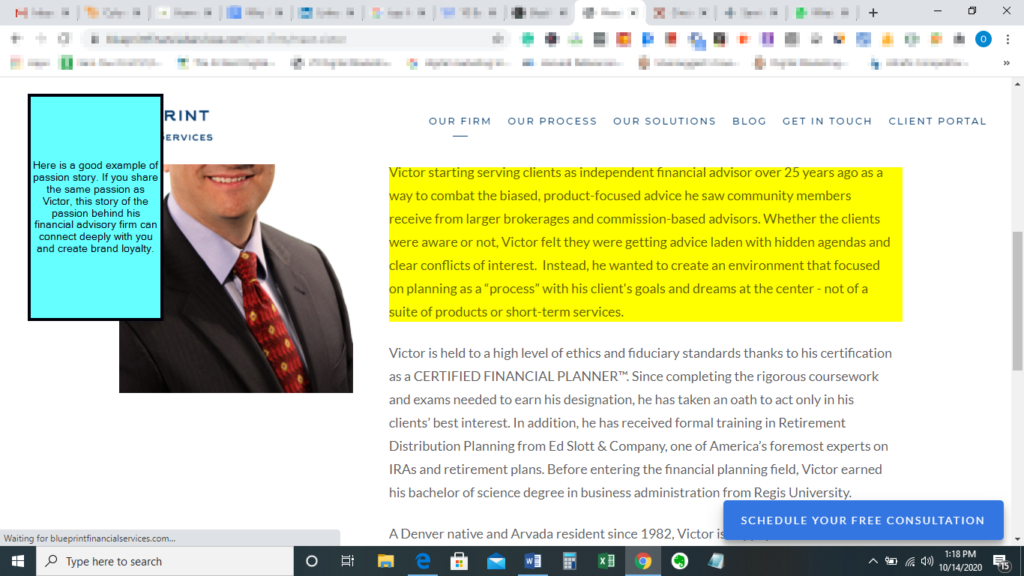

Here is an excellent example of a passion story. If you share the same passion as Victor – combating biased and product-focused advice -this story of the passion behind his financial advisory firm can connect deeply with you and create brand loyalty.

Here is another great passion story. Ben wanted to help people that don’t have the big money that many financial firms are interested in. If you are not an HNWI (high net worth individual), Ben’s passion story may create an emotional connection that leads to a long-term relationship.

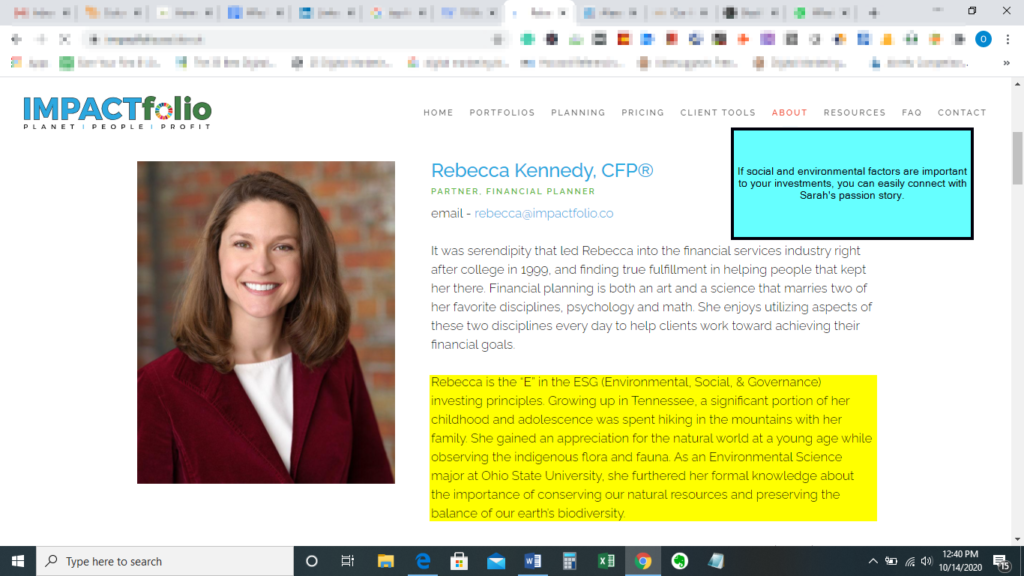

Apart from her Psychology and Math background, Rebecca has a passion for social and environmental issues that originated from her childhood and adolescence in Tennessee.

If social and environmental factors are essential to your investments, you can easily connect with Sarah’s passion story.

Business Story

The business story is an outgrowth of the passion story. While the passion story answers the “why,” the business story includes the “what” and the “how” and how they relate to the “why.”

The “what” are your goals, and the “how” include the products/services, processes, and core values that help you achieve those goals.

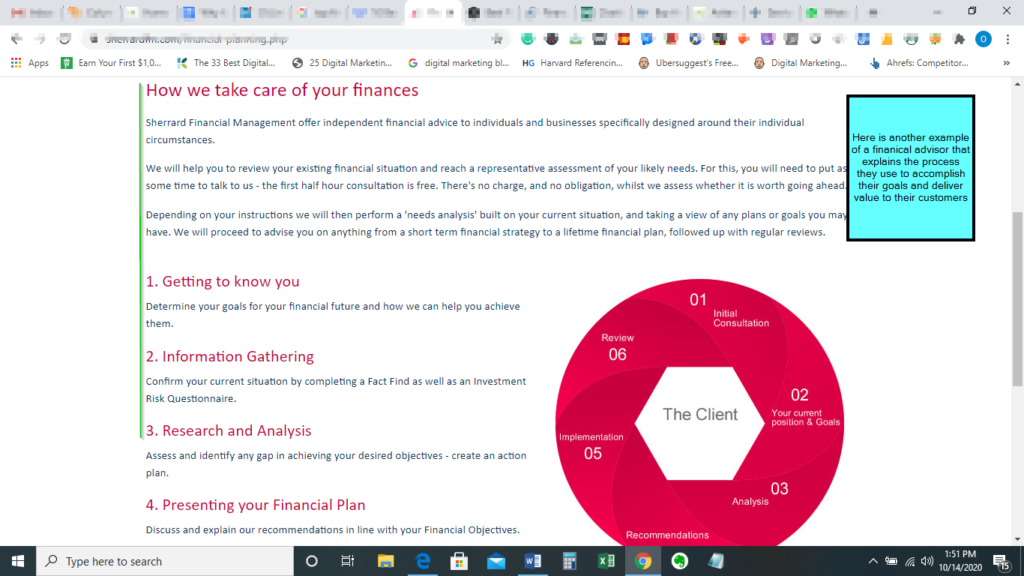

Processes

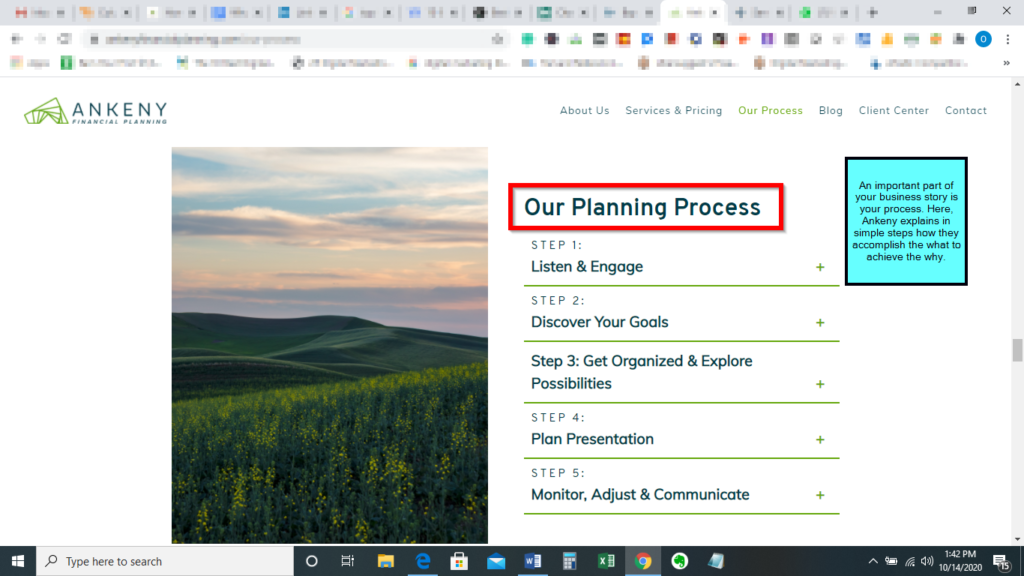

An essential part of your business story is your process. Here, Ankeny explains in simple steps how they accomplish the “what” to achieve the “why.”

Here is another example of a financial advisor that explains the process they use to accomplish their goals and deliver value to their customers.

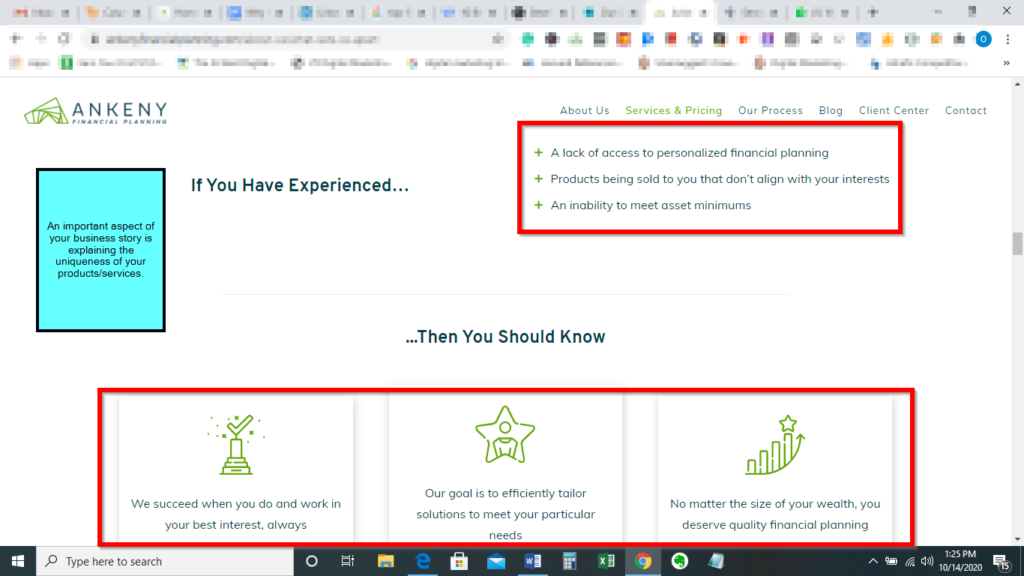

Values and Unique Selling Point

An important aspect of your business story is explaining the uniqueness of your products/services.

Here is another financial advisor that understands the importance of a unique selling proposition in a business story.

Here is a remarkable statement of values from Blueprint Financial Services. They don’t come more concisely.

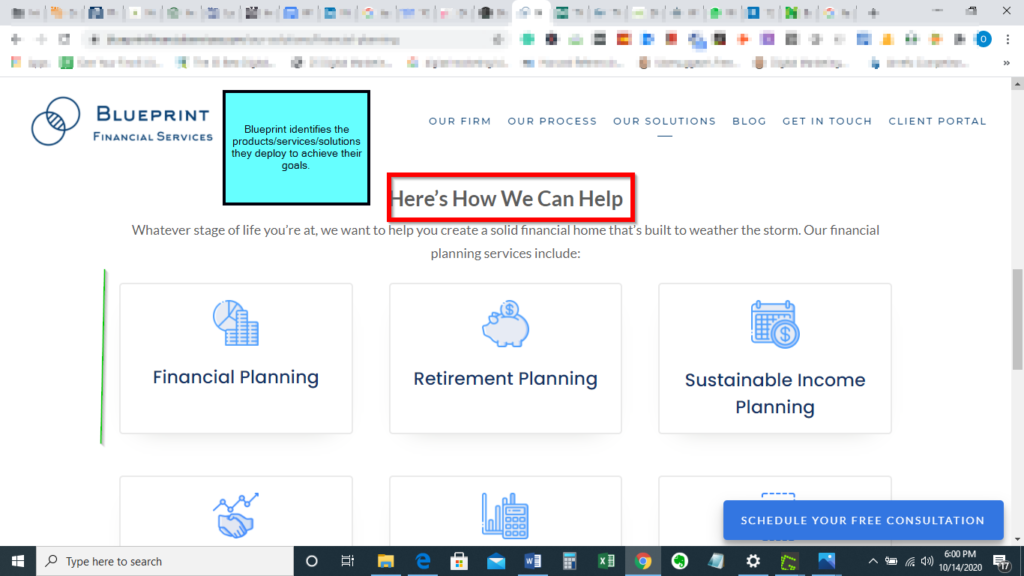

Products/Services

Blueprint Financial Services identifies the products/services/solutions they deploy to achieve their goals.

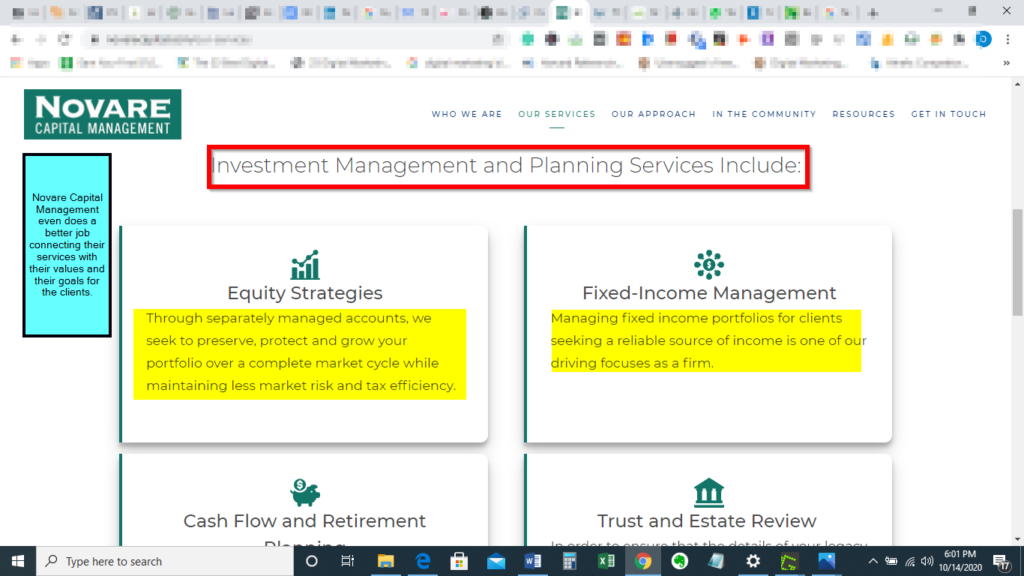

Novare Capital Management even does a better job connecting their services with their values and their goals for the clients.

Customer story

Telling your customers’ stories is an excellent way to answer potential customers’ objections and deepen your connection and engagement with current customers.

Remember, in today’s business world, consumers want to feel like they are an essential part of your organization.

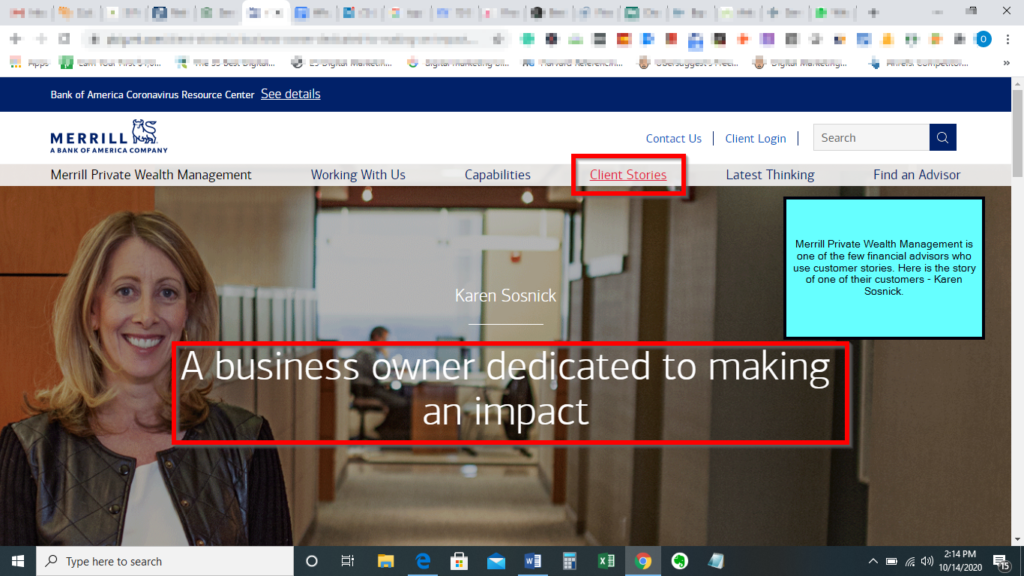

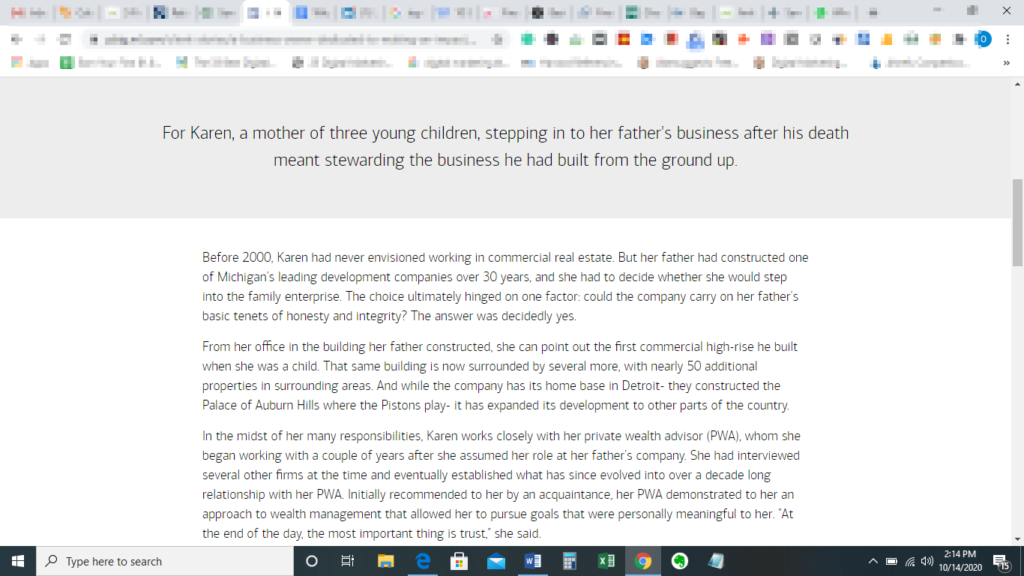

Merrill Private Wealth Management is one of the few financial advisors who use customer stories. Here is the story of one of their customers – Karen Sosnick.

Here is another customer story from Merrill Private Wealth Management.

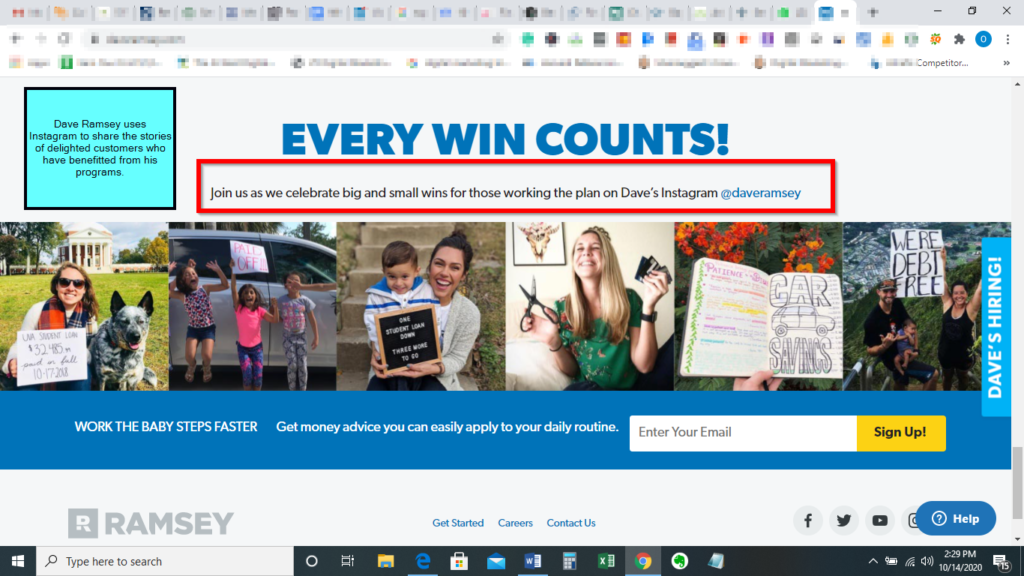

Dave Ramsey uses Instagram to share the stories of delighted customers who have benefitted from his programs.

Storytelling as a content strategy

Apart from static pages on your website, storytelling should be a strategy behind your content marketing efforts.

We looked at the basic elements of a story and the hero’s journey.

Every business should adopt a customer-centered and brand-led approach to storytelling as an important content strategy.

By creating content using this strategy, you can connect emotionally with your client as you depict them as the story’s protagonist/hero. You also foster commitment and loyalty to your brand by depicting your brand (products, processes, and values) as the means through which they can become the hero.

Below are a few examples of financial advisors who did this to some degree.

Here is a set up for a good plot. The reader is the hero or protagonist; debt is the enemy. Debt is the hindrance to building wealth and the dream future. The reader can’t find a way out. He’s stuck with this enemy.

Here is the resolution. Here is the way to overcome the enemy and become the hero by achieving your goals and the life of your dreams.

See how the writers developed a story plot here. The reader is the protagonist; limited income and expenses are the enemies/trials/difficulties. The reader’s goal is to live a comfortable, debt-free life, but in front of him are these enemies.

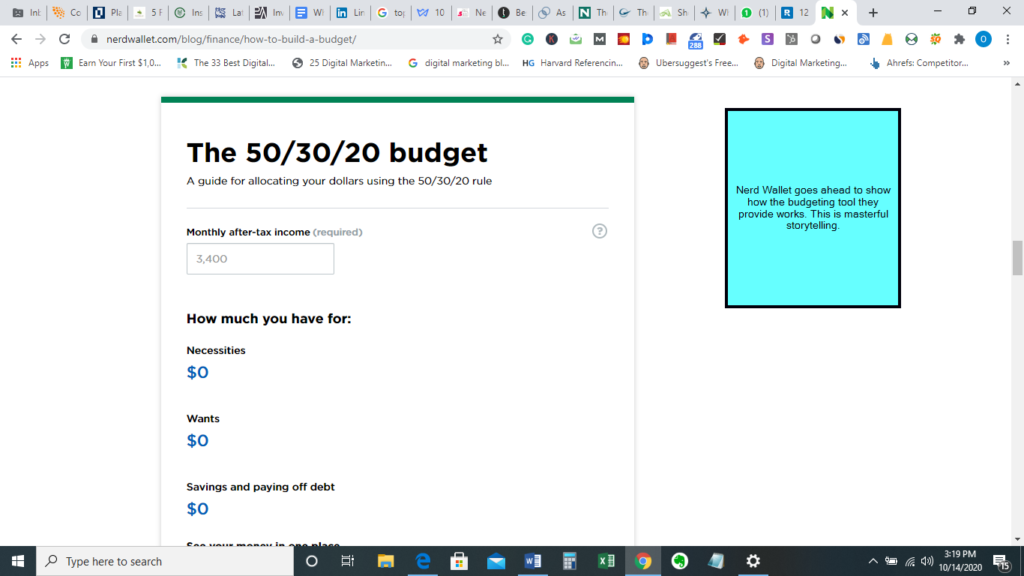

Notice the brand-led solution that Nerd Wallet provides. They showed how budgeting could help the protagonist overcome his challenges and lead him to the life of his dreams.

However, they also show how the Nerd Wallet’s budget tool can help the protagonist become a hero. Customer-centered and brand-led.

Nerd Wallet goes ahead to show how the budgeting tool they provide works. In other words, we can help you overcome the obstacle on your way to glory, and here is how we do it. This article is an example of masterful storytelling.

Some Comments

Passion Story

I expected that every financial advisor would tell their passion story on their websites. However, that is not the case.

Most of the “about us” or “who we are” pages contain only business clichés and generic statements. They mostly contain information about when the company started, what they do, and the states they serve.

You won’t read a story that will grab your attention and connect with you emotionally.

Nevertheless, few financial advisors tell their passion story. However, most of those stories are too short and basic; there is a big room for improvement.

Business Story

Most financial advisors do a good job identifying their products/services, processes, and values. However, many of them could do a better job tying those three things together with their goals in a storytelling approach.

After the passion story section of “about us” or “who we are,” the rest of the page should tell a story about how the products/solutions, processes, and values fit into this passion and the goals that result from the passion.

Customer story

To my utmost surprise, most financial advisors don’t include their customer stories on their website – not even testimonials. It’s so incredible.

If there is any industry where customer testimonials and stories can be the tipping point that turns prospects to customers, it is the financial services industry.

Financial advisors must do better.

Product story

You should have noticed that there are no examples of a product story. Well, I could not find any.

It’s either the solutions that financial advisors offer are too generic to tell a story around, or they don’t understand how storytelling can help attain product differentiation.

By naming your solutions and telling the story behind their creation (connected to your passion and goals), you can connect deeply with customers and enjoy brand loyalty.

Storytelling as a content strategy

Financial advisors perform woefully here. Almost all the content on most financial advisors’ websites are so dry. In a bid to educate and inform, financial advisors ignore storytelling and produce content that are bad for marketing.

Customer-centered and brand-led storytelling is the way to create content that generate customers on auto-pilot.

Financial blogs like Nerd Wallet understand this, but financial advisors don’t.

Conclusion

The use of storytelling is not as pervasive as it should be in the financial services industry. While there are good examples of advisors telling their passion story, business story, and customer story, they are not doing well enough.

Also, most are not telling their product story or deploying storytelling as a content strategy.

In essence, financial advisors are leaving big money on the table.

By telling these four stories well and incorporating storytelling as a content strategy, advisors will see significant improvement in their practice.

If you don’t know how to start, revisit last week’s blog. If you need help, let’s talk.

0 Comments