Introduction

One of the dreaded days in the calendar for many people is April 15. Many refer to it as the ‘tax day.’ April 15 is the due date for individuals, businesses, and charitable organizations to file their tax returns with the Internal Revenue Service (IRS).

N.B: If April 15 is a weekend or public holiday, the tax day for that year is the following business day.

April 15 is also the day that taxes become due for payment. The failure to file for taxes will lead to a 5% penalty on the unpaid taxes for every month the taxes remain unpaid (up to 25%). Also, failure to pay taxes owed for the previous year on tax day will lead to a penalty of 0.5% of unpaid taxes for every month the taxes remain unpaid (up to 25%).

However, filing tax returns can be a very strenuous process for many people.

In this article, we look at

- Steps to filing a tax return

- The different tax forms you might have to fill

- How long you need to retain tax returns

- When you should amend your tax returns

- The different payment options you should consider if you cannot pay taxes by the due date

Let us dive in.

Steps to Filing a Tax Return

- Fill the forms and complete necessary paperwork

The first step to filing a tax return is to ensure you fill all the necessary forms and provide all the required information. Below you will find the forms that apply to you as an individual, business, or nonprofit organization. You should also keep the receipts for all the donations and expenses for which you want to claim deductions (if you do not want to go with the standard deduction) or tax credits.

You can decide to fill the forms manually, use tax software like Turbo Tax or H&R Block, or hire a tax accountant. The factors to consider are your availability, your budget, and your interest in and understanding of the tax process.

- Decide on your filing status.

There are three options available for you: single filing, joint filing, and filing as the head of household.

- Decide on itemized deductions or standard deductions.

This is a crucial decision that will affect many aspects of the filing process. With the standard deduction, you get access to a fixed amount of deduction depending on your filing status. Itemized deductions allow you to compile and sum up your tax deductions. The resulting figure may be lower or higher than the standard deduction.

- Pay your taxes

By now, you should know the amount you owe in taxes. Pay your taxes and breathe a sigh of relief for another year.

If you are self-employed, you will pay your taxes every quarter. Every quarter, you will estimate the amount of taxes you should owe and pay that amount to the IRS. The estimated tax system is for sole proprietors, partnerships, S corporation shareholders, and self-employed individuals. The due date for filing and payment is usually April 15 (for the first quarter), June 15 (for the second quarter), September 15 (for the third quarter), and January 15 of the following year for the fourth quarter.

N.B: If April 15, June 15, September 15, or January 15 is a weekend or public holiday, the tax day is the next business day.

What if you cannot pay your taxes on the tax day? Well, you will have to read to the end.

Tax Forms

A tax form is a document that collects relevant tax information about the taxpayer.

The world of tax forms is very complicated. Though it is not rocket science, it does feel like that some times. Currently, there are over 800 tax forms and schedules. A schedule is an attachment to a tax form that provides important and supporting information alongside the information in the form.

The good news is you do not have to fill those 800 forms and schedules. So much relief, I guess.

Broadly speaking, there are three essential categories of tax forms:

- Income: These tax forms collect information about your income sources. They include forms for employment and non-employment income.

- Deductions: These tax forms collect information that helps to itemize your deductions.

- Credits: Taxpayers use these tax forms to claim tax credits.

Below are the most popular tax forms you will need to fill:

- W-2 Form: Businesses use this form to report wages paid to employees and the taxes withheld from them. This is one of the essential forms for the Social Security Administration (SSA).

- W-3 Form: This is the summary page of all W-2 forms.

- W-4 Form: Employers use this to record the amount of tax withholding to deduct from employees’ wages.

- Form 1040: Form 1040 is the primary form through which individuals file a personal income tax return. The form has two pages with up to 20 schedules. Not all of the schedules will apply to an individual taxpayer, though. Below are examples of some of the schedules in form 1040:

- Schedule A: For allowable deductions

- Schedule B: Interest and dividend

- Schedule D: CGIT and losses

- Schedule E: Income and expenses arising from the rental of real property, royalties, or from pass-through entities

- Schedule EIC: For earned income credit

- Form 1120: This is the form for C corporations to report their tax information.

- Form 1120 S: For S corporations

- Form 1120-C: For Cooperative associations

- Form 1120-H: For homeowners association

- Form 990: This is the nonprofit organizations’ version of the Form 1120.

- Form 1065: For partnership income

- Form 1041: For estates and taxes

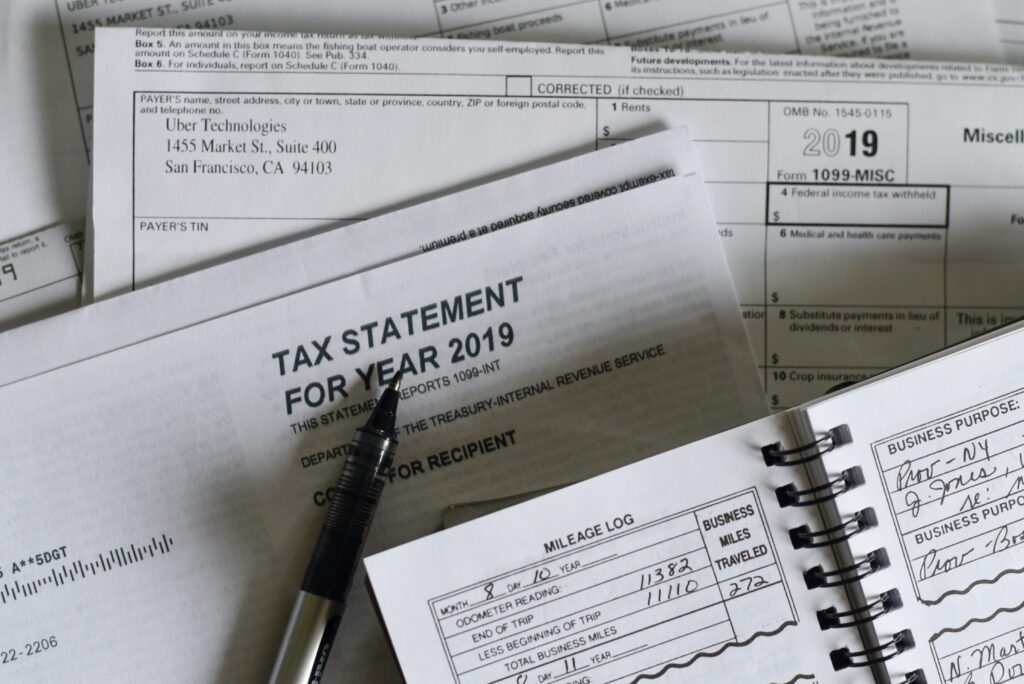

- Form 1099: There are series of Form 1099 that record income from non-employment related sources

For a comprehensive list of the available forms and schedules, check this page. Caveat! Most of the stuff there is boring. The important thing is to concentrate on the forms above that pertain to you as an individual, business, or nonprofit organization.

Retention of Tax Returns

For how long should you keep your tax returns?

According to the IRS, it depends on the action, expense, or event that affect those records.

At the minimum, they advise that you keep your tax returns for three years. You should keep them for up to six years if you failed to report income that is more than 25% of the gross income on that return. If you file a claim for a loss from worthless securities or bad debt deductions, you should keep it for seven years.

The IRS also advises that you keep employment tax records for at least four years. If you file a fraudulent return, you should keep your tax returns indefinitely.

Amended Tax Returns

There are times when you need to amend your tax returns. You may need to correct errors on the tax returns or claim a tax status that will increase your tax advantages (e.g. refund).

Below are the conditions where the IRS allows amendment of a tax return:

- A change in filing status: An example is a change from single filing to joint filing after a marriage.

- An inaccurate number of dependents. You can reduce or increase the number of dependents you report on your tax returns as situations warrant.

- Tax credits or deductions not claimed or incorrectly claimed: If you underestimated your tax credits or deductions, you could request for an amendment of your tax returns.

- Incorrect income: If you understate or overstate your income, you can amend the tax returns and correct the error.

- If your tax liability is more than what you paid, you can amend your tax returns and avoid penalties.

You can apply for an amended return through Form 1040X. The process can take sixteen weeks or longer. Also, if the amendment process results in a tax refund, there is a three-year statute of limitation (from the day you filed the original tax return) on such claims. In other words, you cannot claim such refunds three years after you filed the original tax return.

The Different Options for Tax Payment

If you cannot pay your taxes after filing your tax returns, there are specific options to consider:

- Payment Plans: These are arrangements with the IRS to pay the taxes you owe within an extended timeframe. There is a short-term payment plan that allows you to pay within 120 days (plus accrued interest and penalty). The long-term plan is a monthly instalment payment agreement. The long-term option comes with extra set-up fees ranging from $31 to $225 depending on the mode of payment. Check if you qualify for the payment plans here.

- Offer in Compromise: This program allows you to settle the taxes you owe for less than the amount you owe. You will need to fill some forms and pay a $205 application fee (nonrefundable). The application may be successful or not. There are two payment plans: lump sum cash, where you pay 20% of the total offer during application and the rest over five instalments; periodic payment where you make an initial payment during application and pay the rest every month until you settle your account. Click here to check if you qualify.

- Temporary Deferment: If you cannot use any of the options above, the IRS may agree to delay your payment temporarily until your financial status improves. They will keep assessing your financial situation until you can pay. However, the penalty and interest will keep accumulating. Click here to check if you qualify.

Tax Refunds and Tax Bills

After filing your tax returns and paying the tax owed, the IRS will evaluate your returns. Upon the evaluation, they will discover if you overpaid or underpaid your taxes.

If you overpaid your taxes, you are eligible for a refund. The IRS will deposit the refund into your bank account, send a check or use it to offset your tax liability for the upcoming year.

If you underpaid your taxes, expect a tax bill from the IRS in the mail.

Conclusion

Tax returns are simple and complicated at the same time. However, with a proper understanding of the filing process, the tax forms, the retention and amendment of returns, and the various payment options for those who cannot pay, you should get a good handle on the whole process.

You can decide to do the heavy lifting yourself, use tax software, or hire a tax accountant.

Whatever you do, ensure you file your tax returns at the right time, every time.

To be notified when the next article in the series drops, subscribe to my mailing list.

0 Comments