Tidying up Your Finances As We Approach a New Year

Many excitements accompany the approach of a new year. One reason for this is the holidays. The holidays provide an opportunity for us to spend time with family members who live in different places. The period leading to a new year is a great occasion to solidify family relationships and enjoy each other’s presence. Another reason for the excitement is that a new year provides fresh opportunities to do the things we could not do in the previous year and to make new plans and create new goals. While the former reason tends to be the major one, the latter is crucial for those who live their lives in pursuit of excellence – people with concrete plans and visions.

In that respect, how should we approach a new year as students of personal finance? As people with concrete plans ad visions of which our finances form an integral part, what should we look forward to as we approach a new year?

Count your blessings

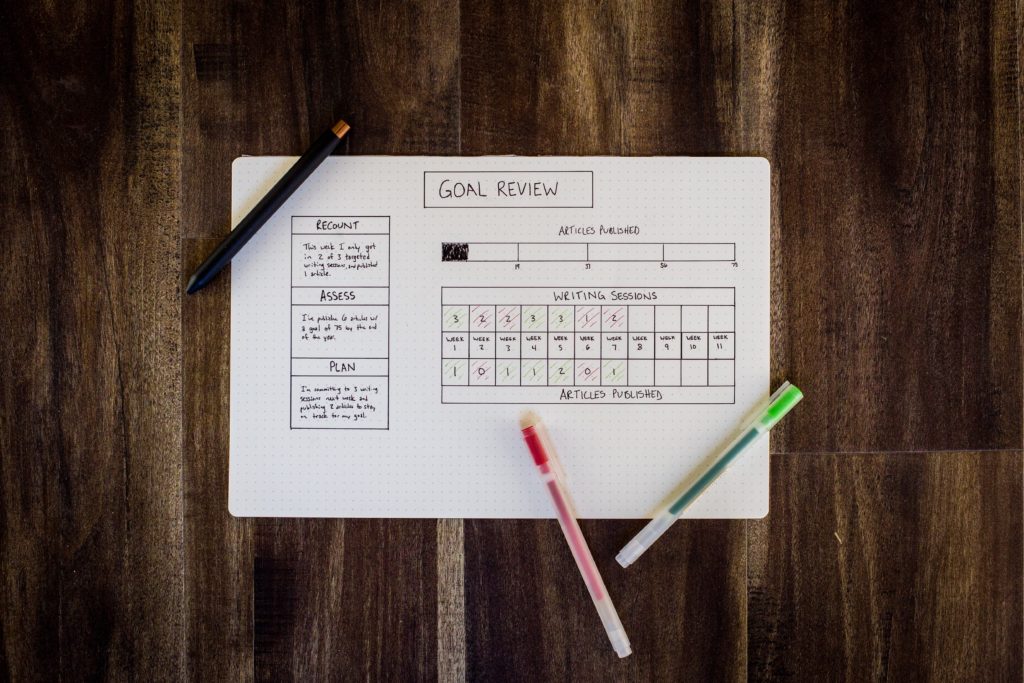

It’s very easy to beat yourself up about the things you could not achieve. But as you look back over the year, the first call of duty is to count your blessings. Look at the financial goals you set for yourself at the beginning of the year. How many did you accomplish? Be grateful for the goals you achieved and even for the things you realized without planning for it. Were you able to improve your credit score? It’s a blessing. Did you get that stock at a reasonable price? It’s a blessing. Did you achieve the exact value of assets you targeted? It’s a blessing.

” It’s very easy to beat yourself up about the things you could not achieve. But as you look back over the year, the first call of duty is to count your blessings.”]

When evaluating the outgoing year, remember the things for which you can be grateful. Do not end the year on a negative note. Count your blessings and enjoy the feeling.

Be honest about your failures

Counting your blessings does not mean you ignore your failures. It means you are putting your failures in the right perspective. If the first thing you do is think about all the things you didn’t do, you will approach the new year with a negative attitude. But if you first enjoy your achievements, you are in the right frame of mind, to be honest about your failures.

” Counting your blessings does not mean you ignore your failures. It means you are putting your failures in the right perspective. If the first thing you do is think about all the things you didn’t do, you will approach the new year with a negative attitude.”]

Did you fail to clear off those credit card debts? Admit it. If you made wrong investment decisions, own up to it. If you went over your budget for no good reasons, be honest with yourself. Acknowledging our failures is essential to making progress in life. Denying them will only give us a false sense of victory. Better to admit the wars you won and those you lost so you could be in a better position to win the battle. Write down your success, but don’t forget to write down your failures as well. But never forget the order. The order is everything.

” Write down your success, but don’t forget to write down your failures as well. But never forget the order. The order is everything. “]

Plan for the holidays

Ideally, your budget should include specific provisions for the holiday season. If you have family around, you need to make provision for them. However, this does not mean you should go over the top. In this article, you will see nine ways to save money in the holiday season. So while making your plans, ensure you stay within your budget. But don’t allow the desire to save money make the holiday less memorable for everyone. The key here is getting the right balance and exploring the nine steps in the referenced article.

Review your budget

How well did you perform? Did your actual expenses equal, exceed, or fall short of your budgeted expenses? What categories of expenses are responsible for those deviations? Is it a bad thing or a good thing? Do you need more significant emergency funds to avoid such variations? Do you need more accountability? Maybe you even need software to better track your expenses.

This step is essential. It will help you identify the factors that are causing deviations so you can make plans to achieve better congruence. Deviating from your budget is not always a bad thing (unforeseen circumstances and situations out of your control). Still, this process will help you identify if the causes of deviations are within your purview or not. If it is the former, then you can do something about it. You should.

Create a new budget

Will your budget for the outgoing year serve you, or are there expected changes that will cause some differences? What’s the nature of those changes and how significant are they? Such changes may be a raise, new mortgage, a debt you want to clear off, marriage, a new child, among others. You will have to try and forecast how any of these will affect your budget for the new year and incorporate them in the new year. A budget is not a static document. It must grow with you as your lifestyle changes.

Evaluate your portfolio

You must not ignore this one area as the New Year approaches. Review your investment portfolio. Your portfolio is an essential part of your finance. It is the goal of all other personal finance habits. The goal is to build good assets and investments, achieve financial independence, and achieve important life goals.

One thing you are looking for is the diversification of your portfolio. Is your portfolio well diversified or concentrated in one particular asset class? Another important consideration is the risk and returns matrix. Are your investments earning you the right return at the risk level? Are there better opportunities with similar risk but higher returns or same returns at lower risk? It is very easy to invest in an asset class and assume it’s the best deal, whereas there are better alternatives out there.

” Is your portfolio well diversified or concentrated in one particular asset class? Another important consideration is the risk and returns matrix. Are your investments earning you the right return at the risk level? Are there better opportunities with similar risk but higher returns or same returns at lower risk?”]

Revisit your short-term goals

Start from the failures of the financial year. Do you still want to pursue those goals you could not achieve? Do you think the problem is with the goals themselves? When designing your short term goals for the next year, you should look for new and better ways to achieve the goals you failed at in the outgoing year (as long as you think those goals are still relevant)

When designing short term goals, ensure it flows out from the long term goals. The harmonization and congruence of goals is key to any long-term success. Your goals for the next year should not be independent of your life goals and your long-term goals. Don’t forget to evaluate how your short term goals will affect your budget.

” When designing short term goals, ensure it flows out from the long term goals. The harmonization and congruence of goals is key to any long-term success. Your goals for the next year should not be independent of your life goals and your long-term goals”]

Continue to learn

Make a plan to read more personal finance books, follow more personal finance blogs, podcasts, magazines, et al. However, it is not just the quantity but the quality. Look for quality blogs, books, podcasts, and magazines that will aid you in your journey. Remember that not all finance experts are really after your welfare. We die intellectually the day we stop learning. Don’t put the brakes on it.

Conclusion

Take charge of your finances. No one will do it for you. The new year is another opportunity to be active rather than passive about your financial life. Follow the steps above, and you will be in a better position to achieve great strides in the new year.

I want to wish you a happy new year in advance. Till we meet again next year, please remember to subscribe to this blog.

0 Comments