“He was supposed to be the Crypto President. Why is my portfolio down by 50%?” You have probably seen such laments by many crypto traders and investors on social media. Or perhaps you have seen pictures like this one showing how various cryptos are falling:

Cryptocurrency performance in March, 2025

Source: Crypto Bubbles

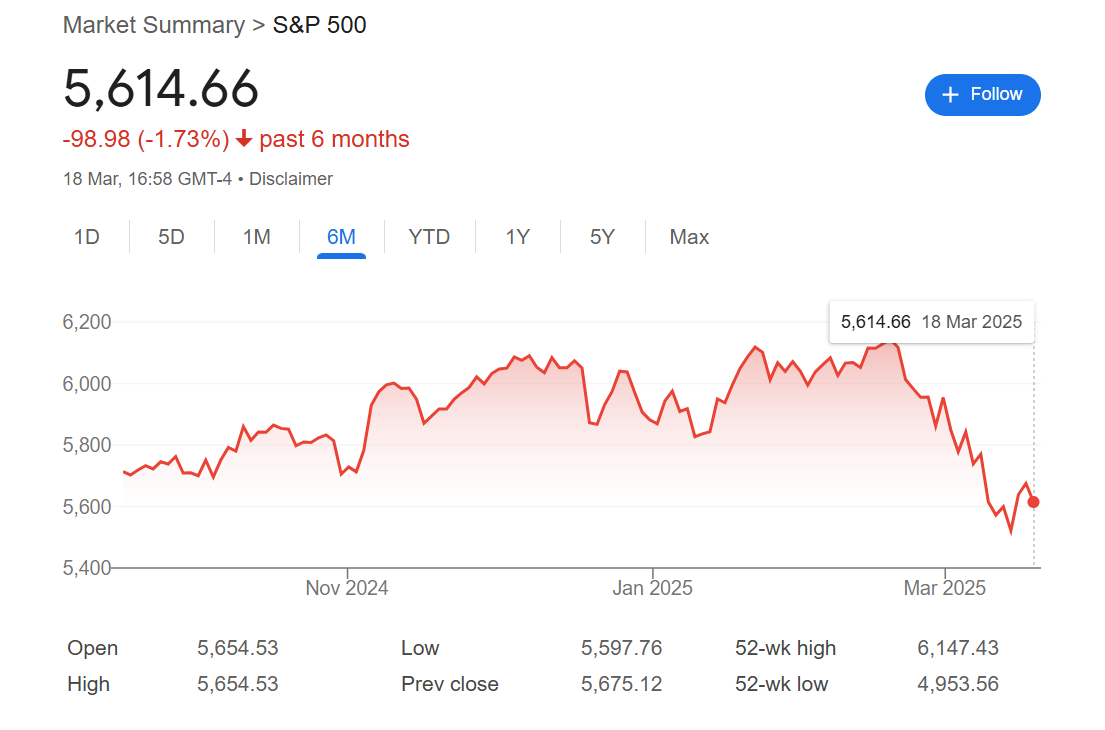

But the current situation is not limited to the world of cryptocurrency; even stock investors who believed that Trump was good for the market lament as the stock market continues to bleed.

For example, the S&P 500 Index fell by 10% from a 6-months peak of $6,144.15 (on February 19) to a trough of $5,521.52 (on March 13) in less than a month.

The S&P 500 Index

Source: Google Finance

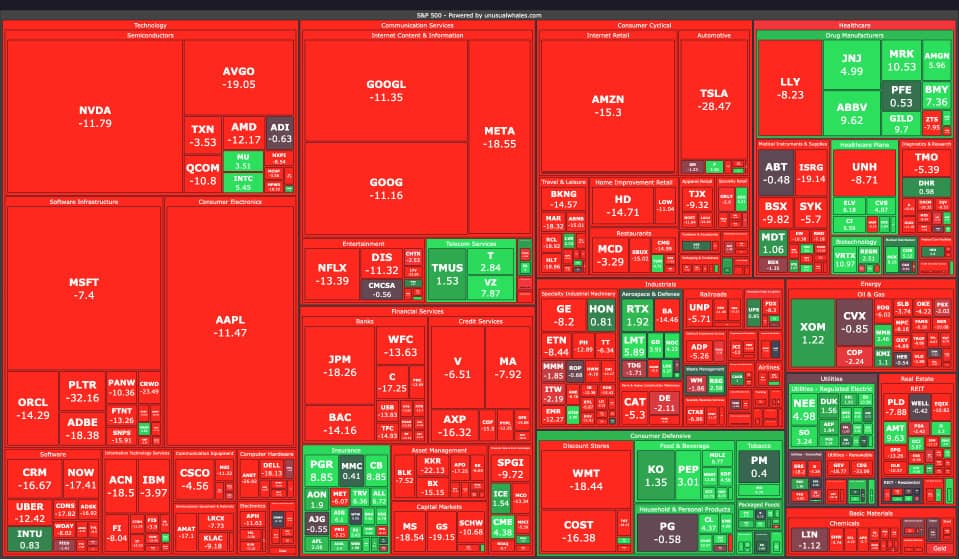

Below is a visual representation of how S&P 500 stocks performed on March 13, 2025, provided by Unusual Whales, a financial data analytics company:

Performance of S&P 500 Stocks on March 13, 2025

Source: Unusual Whales

To say things are bad is just putting it mildly. But what is the cause of all this decline?

What is behind the current situation in the markets?

The current trajectory in the financial markets results from increasing uncertainty about the direction of the world’s largest economy – the United States of America.

Trump’s trade policy (imposing tariffs on selected countries) and its consequences (retaliatory tariffs from those countries) are expected to lead to rising prices even as inflation remains above the Fed’s 2% target.

Many are also concerned about the effect of his cost-cutting efforts (through the Department of Government Efficiency) on economic growth (via jobs) and prices (cuts in public services and housing projects will drive up costs for both individuals and businesses).

On the monetary side, the Federal Reserve paused interest rate cuts in their January meeting. “Economists say it’s likely the Fed wants to take a wait-and-see approach to the Trump administration’s policies such as adding new tariffs and widespread deportations of immigrants, which could both prove inflationary,” according to CBS News. Experts also expect the Fed to maintain the same stance in its March meeting.

It is not surprising then that in February The Economic Policy Uncertainty Index, tracked by the the Federal Reserve Bank of St. Louis, was at the highest it has been since the height of COVID-19.

Given the reality of contagion (the effects of economic events in one nation spreading to others), uncertainty in the US can lead to global uncertainty and cause a drag on the global economy. “Uncertainty could end up weighing on global investment and consumer spending for an extended period, particularly if Trump repeatedly pushes back his tariff deadlines,” according to Capital Economics, a think thank.

Some people have speculated that Trump is intentionally crashing the stock market so that bond prices can go up and yields can come down, a move that is supposed to make the financing of the national debt easier. Others suggest that he is crashing the markets so that his cronies can buy the dip and profit later on.

In an interview with Al Jazeera, Kathleen Brooks, founder of Minerva Analysis, a market analysis company, dismissed such conspiracy theories, highlighting that there are fundamental reasons for the present decline:

“The US economy peaked in November and since then US economic data has been trending lower and surprisingly on the downside. This means that the bond market had to play catch-up. It is not unusual for markets to move in unison like this. This undermines the view that the moves in the Treasury market are a conspiracy theory. Instead, there are good fundamental reasons for the decline.”

What then should you do as an investor amidst this economic uncertainty and its consequences on the financial markets?

Buy the dip

Though this sounds like a cliche, there is wisdom behind it. While stocks are volatile in the short term, they tend to go up more than they go down over the long term.

Thus, times of market correction provide opportunities to buy quality stocks for cheap. As Warren Buffett said, “The best time to deploy capital is when things are going down.” And this is why he keeps a portion of his portfolio in cash (and why you should do the same).

However, just because prices are down does not mean you should buy anything you see. As Buffett also said, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Market corrections should be seen as opportunities to snatch up quality companies at a discount.

This is especially important for value investors. These are the times when many companies will trade far below their intrinsic value (with a high margin of safety). Instead of joining others to lament, see the current moment as an opportunity to lower your average cost and increase your return on investment.

Consider defensive stocks

A look at the chart above, provided by Unusual Whales, shows that some stocks continue to perform well amidst the market decline. While technology and financial services stocks struggle, consumer defensive, utilities, and healthcare, amongst others continue to keep their heads high.

Stocks that tend to produce stable performance in varied market conditions are called defensive stocks. These are stocks of companies with steady (rather than seasonal) demand), which makes it easy for them to produce stable earnings irrespective of economic conditions.

During times of economic uncertainty and market declines, it is not unusual for investors to increase their allocations to such stocks. On March 18, 2025, Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, advised, in a Schwab Network interview, that investors should funnel money into defensive stocks until there is a slowdown in market volatility.

If your portfolio is currently concentrated (usually in tech stocks), allocating a part of it to defensive stocks can be a good way to add some stability as we continue to navigate the current economic uncertainty and market volatility.

Go with diversified rather than concentrated ETFs

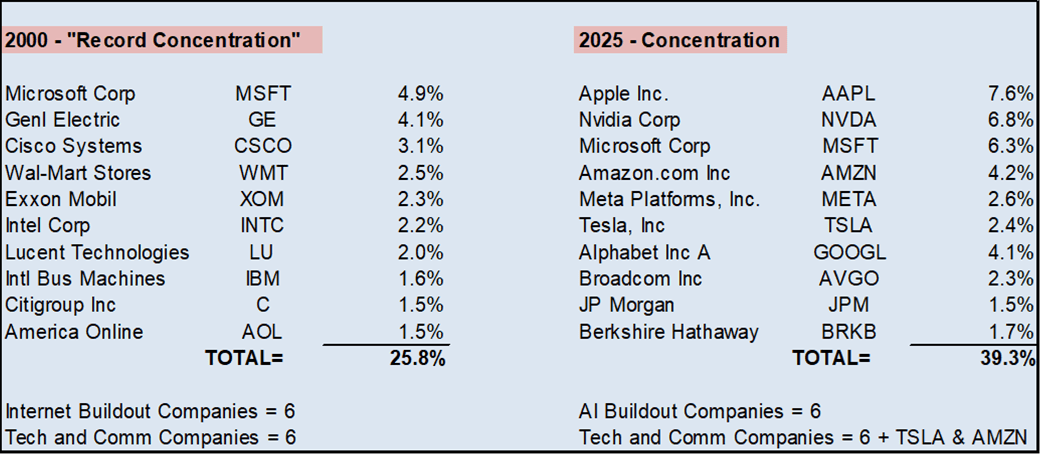

Many analysts have noticed the growing concentration of the S&P 500 Index (and S&P 500 ETFs) as technology stocks, especially the Magnificient 7, dominate.

Over 50% of the gains recorded by the S&P 500 in 2024 came from the Mag 7, according to Faizan Farooque, a financial journalist, writing for Yahoo Finance. He also noted that these stocks now constitute more than a third of the S&P 500 (by market cap).

In 2000, the top 10 stocks in the S&P 500 constituted 25.8% of the index; this increased to 39.3% at the beginning of 2025, according to Osborne Partners, a business consulting firm.

S&P 500 concentration, 2000 vs 2025

Source: Osborne Partners

While this concentration has been good for investors in market upturns like 2024, it is very risky in market downturns. In such moments, S&P 500 equal-weight ETFs – that give equal weight to all the 500 companies instead of weighing them by market cap – can help to reduce risk by providing true diversification.

For example, Invesco S&P 500 Equal Weight ETF (RSP) has outperformed the S&P 500 Index so far in 2025 (-0.37% YTD vs -4.33% YTD). It has also outperformed market cap-weighted ETFs like Vanguard S&P 500 ETF (VOO) and SPDR S&P 500 ETF (SPY), which have produced -4.01% and -4.04% YTD at the time of writing.

In essence, in times like these, truly diversified ETFs can give you an edge in the market.

Asset class diversification may prove essential

There is a fear that current economic uncertainty will give way to a US recession. “Economists and analysts have increased the likelihood of a US recession to 36% due to trade policies and tariffs,” according to The Economic Times.

They pointed to CNBC’s Fed Survey which shows that more than 70% of respondents believe that a trade war will affect the US negatively and that the activities of DOGE will lower economic growth.

Given that gold tends to perform well during economic recessions, including it as a part of your portfolio can make financial sense. In six of the last 8 US recessions, gold has produced positive returns and also outperformed the S&P 500 by an average of 37%, according to Jim Iuorio, a veteran futures and options trader, writing for Forbes.

Gold’s performance during recessions

Source: Forbes

Over the long term, gold can also serve as a hedge against inflation. “Over very long periods (decades or centuries), gold has generally maintained its purchasing power,” according to Al Romaizan, a gold and jewelry company. “However, over shorter periods, the relationship between gold prices and inflation can be less reliable.”

Thus, including gold ETFs in a portfolio can offer protection against economic recessions and hedge against inflation over the long term.

Is it time to move to shorter-term fixed-income securities?

Shorter-term fixed-income securities are safer, more liquid, and less volatile compared to their longer-term counterparts. One feature of great concern to us is that they are less affected by fluctuations in interest rates.

Thus, one way to deal with monetary policy uncertainty is to consider shifting from longer-term fixed-income securities to shorter-term fixed-income securities, according to Marguerita Cheng, the CEO of Blue Ocean Global Wealth.

Shorter-term bonds are currently more attractive than longer-term bonds, according to Jeffrey Rosenberg, Managing Director of Systematic Fixed Income at Blackrock, the global investment firm:

“Our prediction for a ‘new conundrum’ played out in 2024 as long-end yields moved higher despite the start of interest rate cuts—going against the ‘bonds are back’ consensus narrative. For 2025, the potential for further steepening reinforces the importance of where you hold your duration, with the short-end and belly of the curve appearing most attractive.”

Julian Howard, the Chief Multi-Asset Investment Strategist at GAM Investments agrees. First, he highlights the fact that long-dated bonds may not provide the diversification benefits investors desire: “Today, the old stalwarts in the form of long-dated government bonds may not be able to fulfill this diversifying role amid growing correlation to stocks and an uncertain inflation and economic policy outlook which is keeping yields elevated (and prices down).”

Next, he identifies shorter-dated bonds as the diversifier suited for the current environment: “But, to borrow from actor Michael Caine’s philosophy of ‘using the difficulty’, shorter-dated bonds carry advantages precisely because of these conditions.”

Looking beyond the United States

International diversification is another way to reduce your portfolio risk.

Though we mentioned that contagion is always a risk factor for the global economy, at the moment, uncertainty in the US is helping fuel growth outside of it.

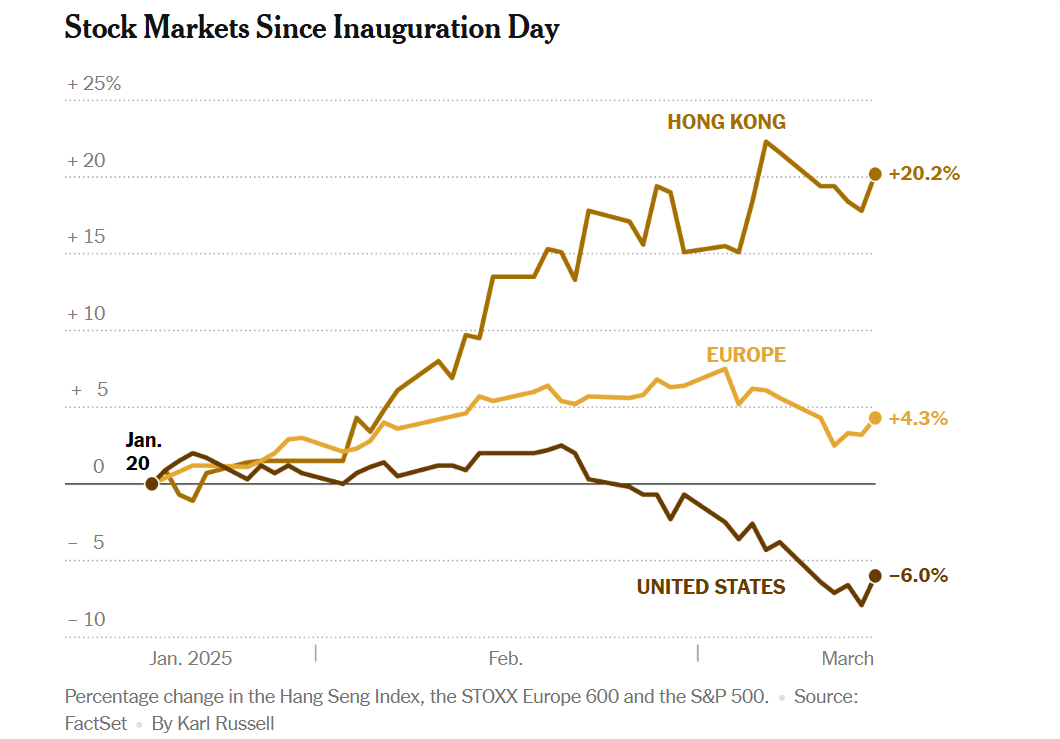

“For years, the S&P 500 soared above the stock indexes of other countries. But since Trump’s inauguration, it has fallen 6 percent and is now trailing major markets in Europe and China,” reported Joe Rennison, a reporter for The New York Times.

Stock markets in China, Europe, and the US since Trump’s inauguration

Source: The New York Times

Rennison also noted that markets in Europe have been bolstered by new military spending, a step that they are taking in response to Trump’s recent comments about Europe defending itself. Reduced red tape and the unwinding of the big tech trade in the US are additional factors, according to Gregor Hirt, Global Chief Investment Officer (CIO) of Multi Asset and Andreas de Maria Campos, a fund manager at Allianz Global Investors.

All of these have resulted in fund managers recommending ex-US stocks to clients. “In recent weeks, Wall Street has sent out a raft of bank research notes, client presentations, and trade ideas that recommend a pivot away from the United States,” Rennilson noted.

However, he also highlighted that the US has the bigger potential over the long term and that any economic downturn in the US will affect these other markets (again, contagion). Thus, instead of exiting the US market, you should focus on reducing your portfolio’s concentration by including international stocks.

“Continued policy uncertainty and worsening economic data in the US may give investors further reason to favor Europe,” said Hirt and Campos. “Of course, the picture could change if Mr Trump delivers on his threat to impose 25% tariffs on the EU, escalating the trade war. But overall, we think recent equity market shifts give fresh impetus to building an active and diversified approach to asset allocation.”

Conclusion

“Diversification may preserve wealth, but concentration builds wealth,” said Buffett.

We currently live in a time where the first part of that quote is most relevant. In times of uncertainty and high volatility, diversification is needed to preserve wealth. And this is why the strategies suggested above all revolve around it.

Given that the first rule of investing is not to lose your money, according to Buffett himself, diversification, especially in market downturns, is very essential. Only those that preserve wealth in bad times can build it in good times.

0 Comments