In a previous article, we considered why financial advisors need to niche down to stay above the fray and build a loyal audience.

The globalized economy and increasing technological advancements have increased the competition that businesses, including financial advisors, face.

To succeed, financial advisors should carve out niches out of the general market where they can dominate, create a recognizable brand, and generate the kind of following and loyalty that makes them a niche leader.

Having looked at the benefits of niching down, let’s consider some examples of financial advisors embracing this strategy.

Niche by product

To niche down by product is to create expertise in one area of financial planning. Instead of offering a robust financial plan covering all the basics, these financial advisors niche down by targeting one specialized service-say retirement planning.

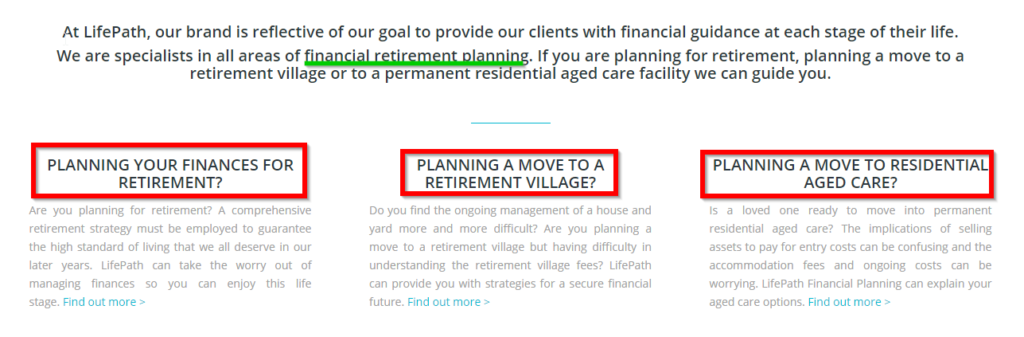

LifePath Financial Planning is a financial advisor that specializes in financial retirement planning

Life Path does not brand itself as a generalist financial advisor who provides a comprehensive financial plan; instead, they focus on helping aged people with retirement and aged care solutions.

They also have great copywriting on their homepage that highlights the three major services they offer: planning finances for retirement, planning a move to a retirement village, and planning a move to residential aged care.

By focusing on this niche product, they have developed the specialist experience, knowledge, and capacities to provide a top-notch service that a generalist cannot.

If you have an aged parent, won’t you rather trust Life Path, a financial advisor specialized in aged care solutions and retirement than a generic advisor who does it all?

Niche by market

To niche by market is to offer all the services a typical financial advisor provides (retirement planning, estate planning, tax planning, etc.) but to a specialized market.

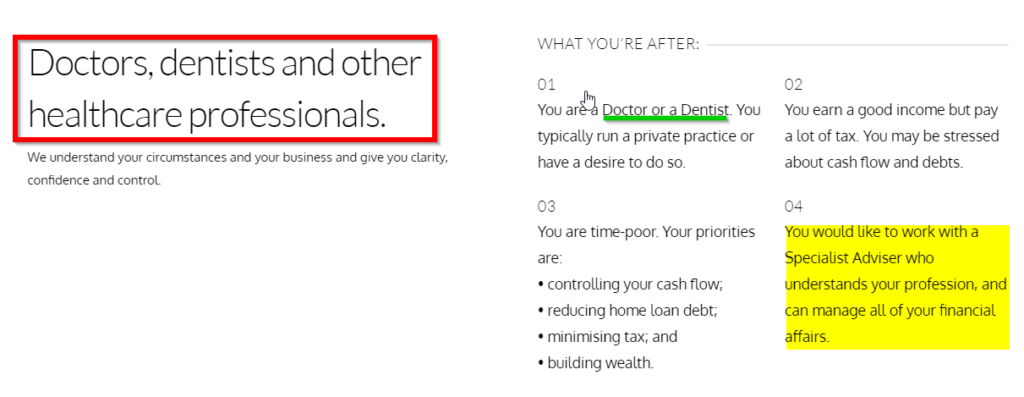

Affluence Private is a financial advisory firm that focuses on the financial planning needs of doctors, dentists, and other medical professionals.

Through years of working with medical professionals, Affluence Private understands their unique challenges and opportunities, helping them provide specialized and personalized services that a generalist cannot provide.

This line is particularly important: “You would like to work with a Specialist Adviser who understands your profession, and can manage all of your financial affairs.” Won’t you if you are a medical professional? A specialist who understands your unique circumstances or a generalist who perhaps has never worked with any medical professional?

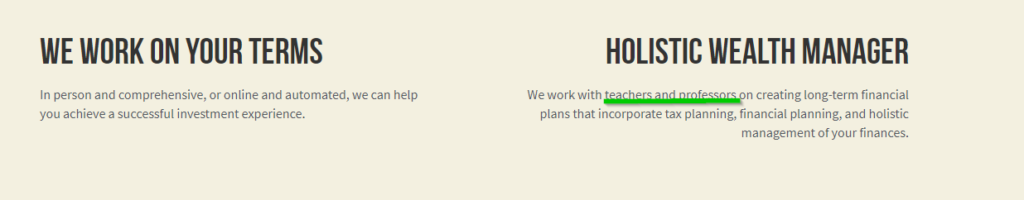

Teachers Financial Advisor is another financial advisor that niches down by market. This advisory firm offers full-scale financial planning services for teachers and other educators. Founded by a teacher and instructor himself, TFA has the knowledge and experience to meet teachers’ unique financial needs.

“We work with teachers and professors on creating long-term financial plans that incorporate tax planning, financial planning, and holistic management of your finances.”

This positioning is easy to create brand loyalty around.

Niche by demographics

Niche by demographics is a form of niching down by market. However, I believe it deserves a category of its own.

These financial advisors focus on a particular age group or gender.

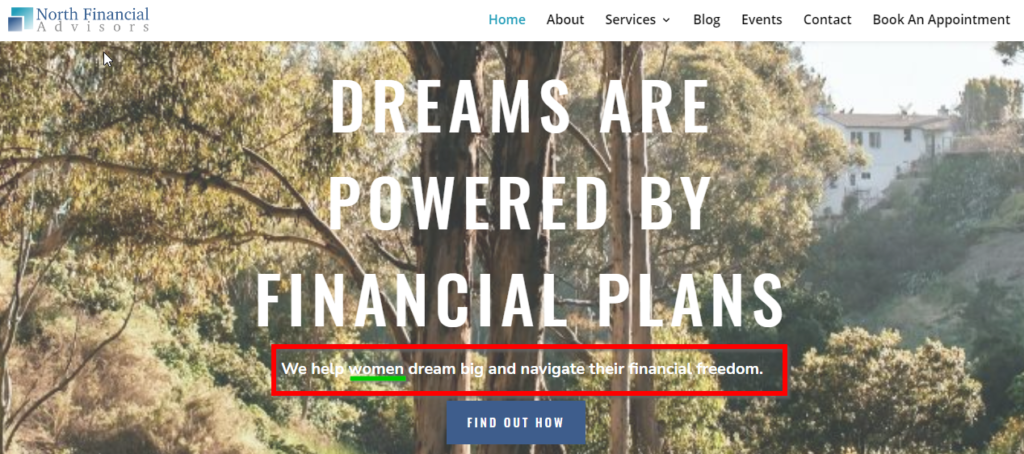

North Financial Advisors is an advisory firm that focuses exclusively on the financial planning needs of women, especially women entrepreneurs.

The mission of North Financial Advisors is clear: helping women dream big and navigate their financial freedom.

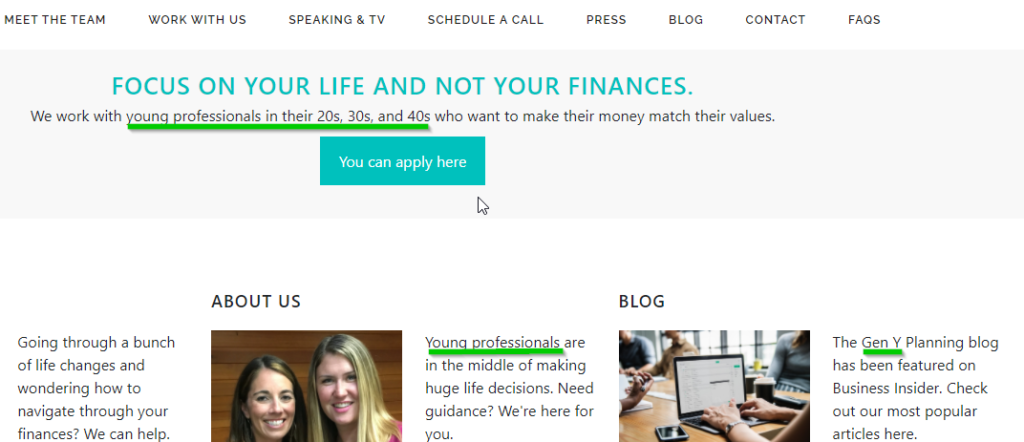

Gen Y Planning is another financial advisor that niches down by demographics; in this case, the focus is on Gen Y professionals.

People belonging to Gen Y are called Millennials- born between 1981 and 1996. That demographics currently include people who are between 24 and 39 years of age.

Gen Y has garnered the experience and expertise needed to care for the financial needs of Millennials. By focusing on this group, they have carved out a niche where it is easier to build brand loyalty. A young professional (a Gen Y professional) will be more attuned to work with an advisory firm dedicated to people like him than a generalist.

Conclusion

Niching down is the best business decision financial advisors can make in today’s business climate. For those who still hesitate, the above examples show that many advisors are already treading this path.

By niching down, you can reduce your marketing budget, build brand loyalty, increase your fees, become the niche leader, enjoy reduced competition, and sell more products to your niche.

Why tarriest thou? Choose a niche where your interests and capabilities align, and there is a profitable market, and watch your advisory firm grow.

Have you read my guide: Storytelling as a Content Strategy: A Winning Approach to Content Marketing? It contains everything you need to get better results from your content marketing efforts. Grab your copy now!

0 Comments